Canada's Leading Marketplace Lender

Incorporated in 2018

0

%

Average net annualized

return to investors*

Data as at June 30, 2024, updated quarterly.

Lend to Canadians and earn interest

Data as at June 30, 2024, updated quarterly.

Open your free account to explore the platform, no investment required.

Data as at June 30, 2024, updated quarterly.

Risk: If the borrower doesn’t repay, you may lose money

Mitigation: Diversify your investment across hundreds of borrowers

Risk: You cannot sell your investment early, and terms are typically 3 or 5 years

Mitigation: Monthly repayments are deposited directly into your account

goPeer connects Canadians looking for a loan with Canadians looking to invest.

As a goPeer investor, you invest in Canadian consumer loans, earn interest and monthly passive income – just like a bank!

goPeer offers a new fixed income asset class with low correlation to stocks or bonds.

Invest as little as $10 per loan and diversify your investments across as many borrowers as you wish.

Borrowers make fixed monthly repayments with interest, which are deposited directly into your account.

Use the Auto-Invest feature to automatically select investments and reinvest your earnings to compound your interest.

goPeer is 100% Canadian. When you invest in a goPeer loan, you contribute to helping real people in Canada.

Our innovative approach to lending focuses on financial wellness, empowering Canadians to help each other achieve their goals faster.

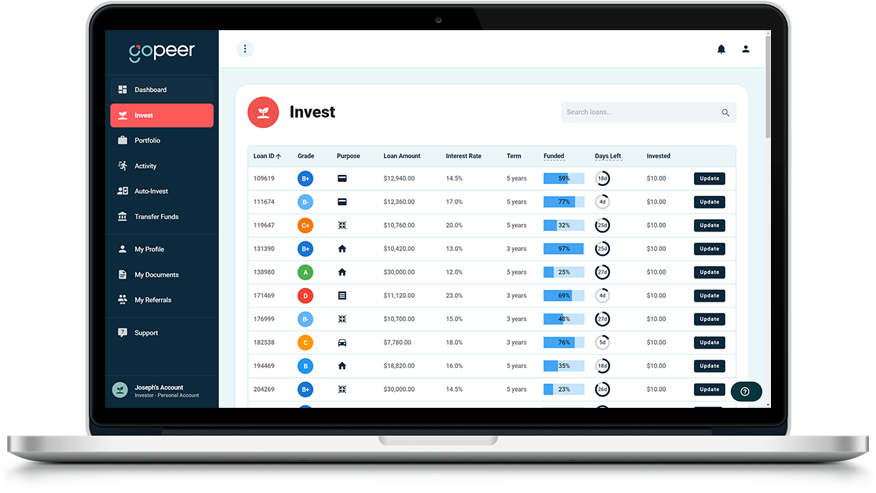

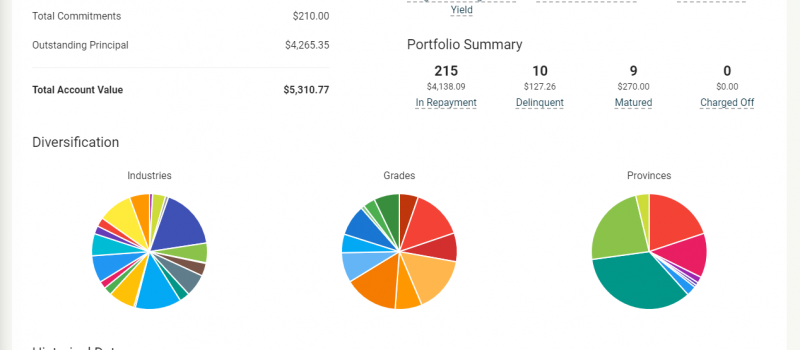

Explore the Marketplace

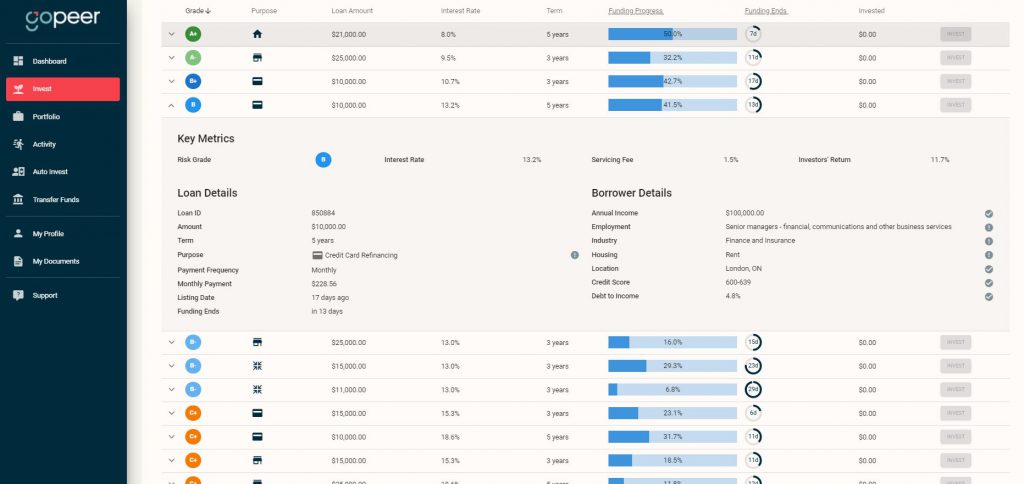

Browse through the platform and select the loans that match your investment objectives.

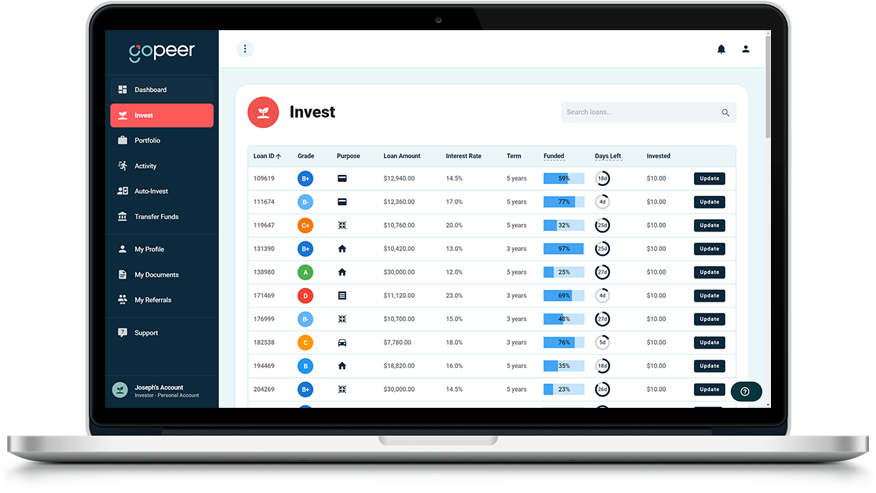

Perform Due Diligence

Each investment note provides borrower details such as their annual income, credit score range, debt-to-income ratio, and more.

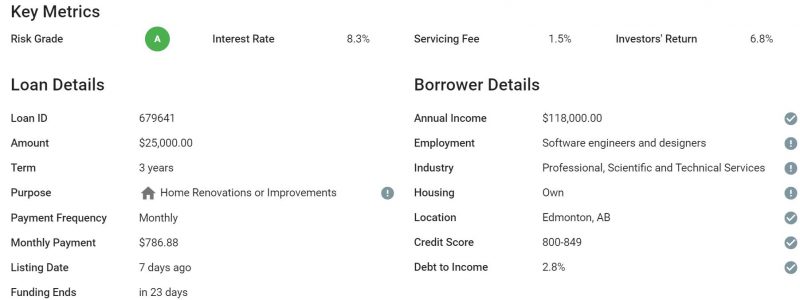

Portfolio & Activity Tracking

Gain in-depth insights of your investments made through goPeer. Export and analyze your portfolio data as you wish.

Investing on Auto-Pilot

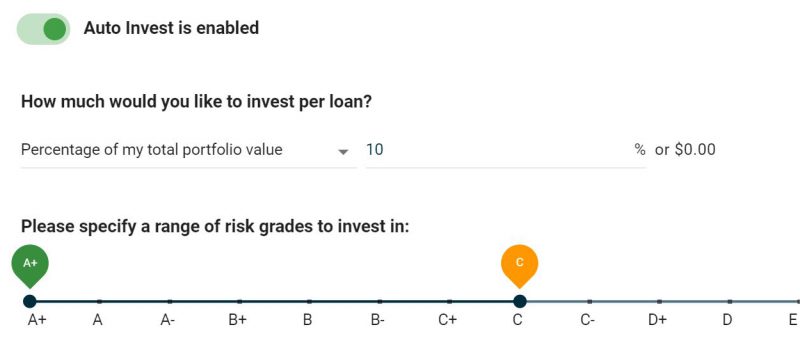

With Auto Invest , goPeer can do the heavy lifting for you. Auto Invest actively looks for investment notes based on your preferred risk grades and uses a portion of your available funds to automatically invest into them.

Investors are assessed a 1.5% annual servicing fee (0.125% monthly) deducted from loan repayments, so you only pay when you earn.

No management, brokerage account, or transaction fees.

No charges to deposit, transfer or withdraw funds.

Earn recurring, monthly passive income in the form of loan installment repayments.

Investors are assessed one low annual servicing fee of 1.5% on the repayments.

Use the Auto Invest automatically select investments and reinvest your earnings.

goPeer has all the necessary licences and permits to operate in compliance with Canadian laws.

Your uninvested funds are held in trust. goPeer uses state-of-the-art data encryption.

When you invest in a goPeer loan, you contribute to helping real people in Canada.

goPeer uses advanced technology to assess every application, so only creditworthy individuals are approved for a loan and placed onto the platform.

With a $10/loan minimum investment, you can spread your investments across as many borrowers as you wish.

When a borrower is unable to fully repay their loan, goPeer handles everything for you. goPeer’s collections and recoveries team works to recover as much as possible for you so that your returns can be as high as possible.

goPeer may solicit its clients to leave public reviews. The testimonials presented may not be representative

of the views of all investors or borrowers, and your own experience may differ.

1 Answer a few questions about your investment objectives.

2We’ll determine what note grades are suitable for you.

3 Transfer funds and start investing.

goPeer is Canada’s leading P2P lending platform dedicated to helping everyday Canadians to lend and borrow from each other. Our innovative approach to lending focuses on financial wellness, empowering Canadians to help each other achieve their goals faster. We are able to offer better rates to borrowers than traditional lenders while allowing everyday Canadian investors to access a new passive income asset class.

Disclaimer:

This information should not be construed as legal, tax, investment, financial, or accounting advice. The information may contain various forward-looking statements, which are statements that are not historical facts and that reflect goPeer’s beliefs and expectations with respect to future events and financial and operational performance. These forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other factors, which may be beyond the control of goPeer and which may cause actual results or performance to differ materially from those expressed or implied from such forward-looking statements. Nothing contained within the information is or should be relied upon as a warranty, promise, or representation, express or implied, as to the future performance of any loans. Investments available through goPeer are not bank deposits (and thus is not insured by the CDIC or other federal governmental agency), are not guaranteed, and may lose value. Investors must be able to afford the loss of their entire investment. This website provides preliminary and general information about the notes available on goPeer and is intended for initial reference purposes only.

Please note:

*Past performance is not a guide to future returns, and your capital is at risk when investing through goPeer. As you are investing to your own individual portfolio of loans, your actual return and the actual bad debt you experience may be higher or lower than projected net returns. Please reach out to a Dealing Representative registered with Peer Securities Corporation (operating as goPeer) if you have any questions.

You are being referred to goPeer Corporation (“goPeer”) by the owner of this promotion that is directing you to this page (the “Sponsor”). The Sponsor may receive compensation in the form of a referral marketing fee including, but not limited to, when you sign up for a goPeer account, open an Investor account with Peer Securities Corporation, fund an Investor account, or invest a certain amount. The possibility of a conflict of interest may arise in any paid referral arrangement. In this case, the Sponsor is receiving a fee for referring you to goPeer and the fee may have impacted their decision to refer you. goPeer is not aware of any actual or potential conflict of interest as a result of your referral.