Mortgage Investing – Invest – ads

High Yield Investments

Invest in your peers and earn interest on your loans

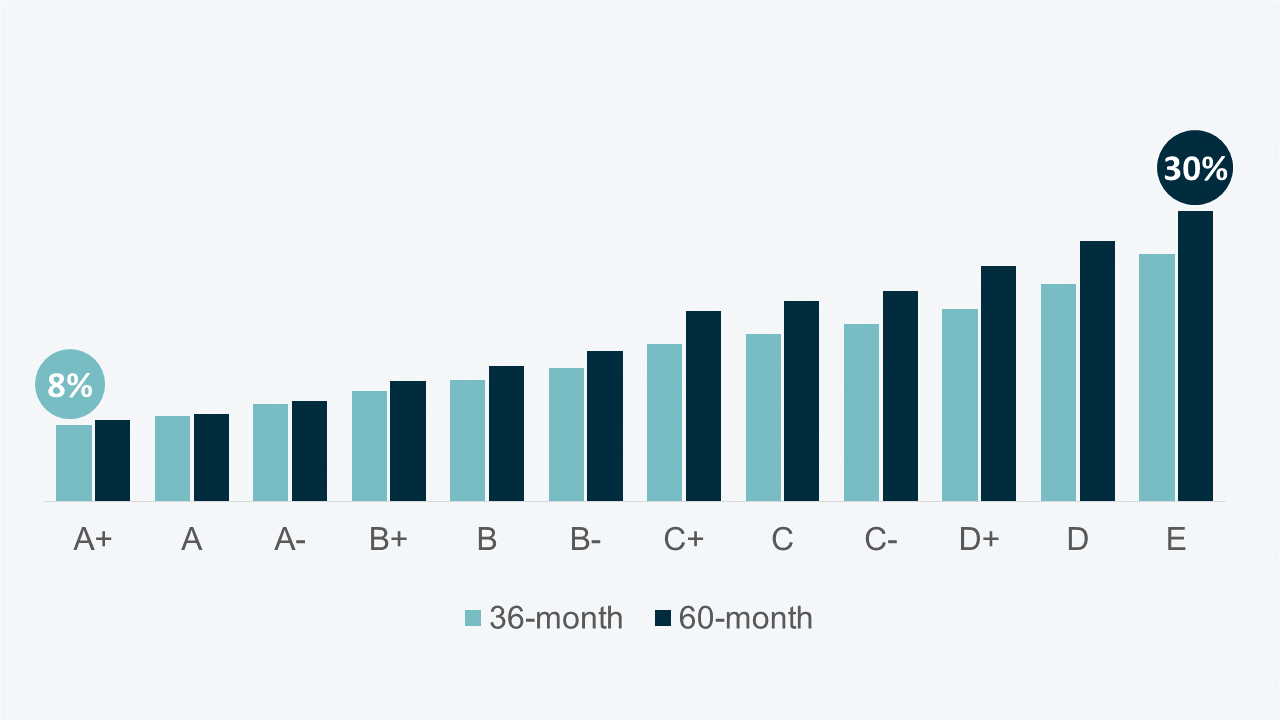

Projected returns between 8% and 30%

How it works

goPeer connects Canadians looking for a loan with Canadians looking to invest.

As a goPeer investor, you invest in Canadian consumer loans, earn interest and monthly passive income – just like a bank!

Diversify your Investment Portfolio

goPeer offers a new fixed income asset class uncorrelated with stocks or bonds.

Invest as little as $10 per loan and diversify your investments across as many borrowers as you wish to stabilize overall returns.

Get Monthly Payments

Borrowers make fixed monthly repayments with interest, which are deposited directly into your account.

Use the Auto-Invest feature to automatically select investments and reinvest your earnings to compound your interest.

Help Fellow Canadians

goPeer is 100% Canadian. When you invest in a goPeer loan, you contribute to helping real people in Canada.

Our innovative approach to lending focuses on financial wellness, empowering Canadians to help each other achieve their goals faster.

goPeer has been featured in

goPeer has been featured in

Previous image

Next image

First consumer peer to peer lending platform in Canada

goPeer is Canada’s first consumer P2P lending platform dedicated to helping everyday Canadians to lend and borrow from each other. Our innovative approach to lending focuses on financial wellness, empowering Canadians to help each other achieve their goals faster. We are able to offer better rates to borrowers than traditional lenders while allowing everyday Canadian investors to access a new passive income asset class.

The average borrower statistics on goPeer

Annual income

$

0

Credit score

0

Loan amount approved

$

0

Interest rate

0

%

Debt-to-income ratio

0

%

Homeowners

0

%

Get started today

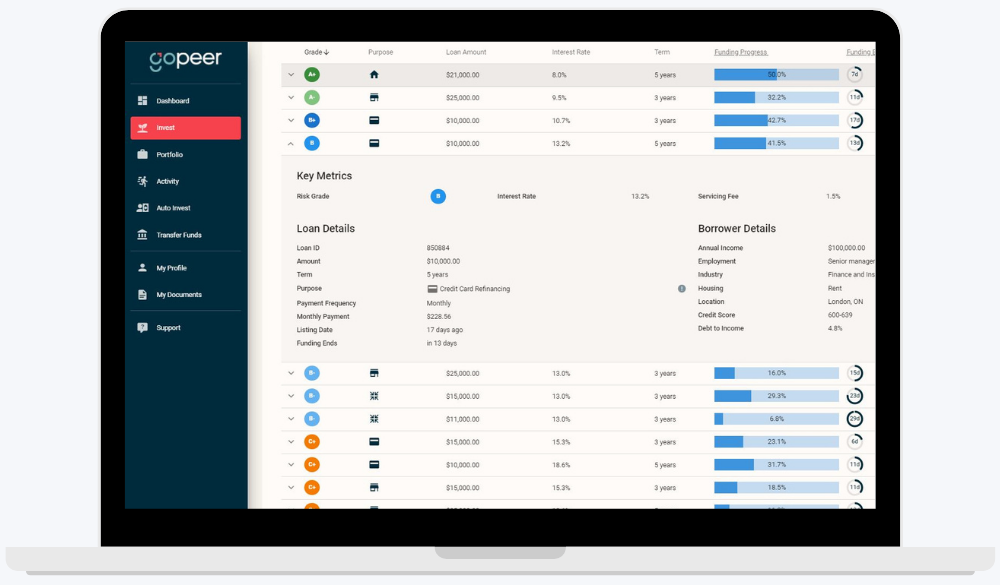

Loan grades and interest on goPeer

Investors gross returns ranges from

8% to 30%

goPeer's mission

In Canada, lending to individuals profit only the big guys – large banks and financial institutions. We want to modernize this archaic system and make these investments available to everyday Canadian investors. The loans offered through goPeer offer an attractive yield, have a low correlation to other asset classes, and most importantly they are accessible to everyone – not just the big guys. By using goPeer, you contribute to shifting the balance of power from the large financial institutions to individual, everyday Canadians.

We aspire to provide individuals with a better borrowing experience. We understand that sometimes unexpected expenses may arise, and banks are just not fast enough to deliver. We’re committed to the financial health of our members and strive to improve the Canadian lending market by offering swift, affordable loans.

Get started today

Have questions? Here are the answers.

Investing

Investment on our platform is open to any individual living in Canada. You do not need to be an accredited investor or financial institution to invest through goPeer.

goPeer connects people seeking loans with investors like you. As an investor on our platform, you are purchasing interest in loans originated by goPeer. More specifically, you are buying payment-dependent notes issued by Peer Capital Corporation, privately placed by Peer Securities Corporation, a registered as exempt market dealer in all Canadian provinces, and which are dependent for payment on corresponding loans originated by goPeer Corporation.

You earn 100% of your pro rata share of the principal and interest (after the servicing fee) as borrowers repay their loans, and you hold the entirety of the risk. No claim may be made against goPeer (or its affiliates) for shortfalls resulting from loan defaults.

goPeer charges a 1.5% servicing fee, which is applied as a 1/12th of 1.5% monthly fee (0.125%) on the unpaid principal balance of outstanding loans. This fee is deducted from borrower payments on the loans underlying your Notes. Peer Securities does not charge any separate or additional brokerage account or transactional fees.

The minimum initial commitment to invest on the platform is $1,000. The minimum amount you can invest per Note is $10. The reason why we have implemented a minimum initial commitment amount of $1,000 was to make sure that any investor could diversify their investments across 100 Notes.

After you have set up your account you will have access to our Investor Portal, which allows you to access the platform, view your portfolio, monitor returns, and much more. You’ll also receive monthly account statements with investment information including portfolio holdings, payment history, and unpaid principal balance.

goPeer is required by law to ensure that your goals and experience as an investor are aligned with this investment opportunity. The suitability section of your investor profile helps us understand your investment experience and objectives, liquidity needs, and risk tolerance. This information will not be used for marketing purposes and will not be sold, rented or loaned to any third party

How it works

We encourage investors to use Auto Invest to build a diversified portfolio and compound the interest earned. However, automated investing is optional. You can browse the platform within the Investor Portal to search for investment opportunities that suit you, subject to diversification requirements.

The Investor Portal gives you the ability to view information such as the borrowers’ locations, industry of employment, annual income and purpose of the loan. You can also view the borrowers’ financial details and see key attributes of the corresponding loans, including debt-to-income ratios, income, and credit score ranges.

Only individuals that have passed our credit assessment process can borrow through goPeer.

New loans are listed frequently. Please check back onto the goPeer Invest tab for the new listed loans.

As you set up your profile, you will provide a bank account to be used for deposits and withdrawals. You can withdraw your repayments as they come in, if Auto Invest is turned off, as well as any of your funds that aren’t lent out. There are no fees to make a withdrawal.

No, due to regulatory restrictions, goPeer does not offer a secondary market at this time. You should invest with the intent and expectation of holding purchased Notes until maturity.

You need to be living in Canada and have a Canadian bank account to be able to invest through goPeer.

goPeer’s collections and recoveries team pursues every single late or defaulted loan to recover as much as possible. We use a variety of methods and technologies that analyze the specific financial situation of each borrower to maximize your recovery.

When a loan defaults, your account will show a total loss of principal. However, we will continue to work to make recoveries, so it’s worth remembering that the amount “lost” on recent defaults may improve over time.

Yes, borrowers can repay their loans early without a prepayment penalty. If this happens, your outstanding principal will be returned to your investor account where it can be lent to other borrowers.

Please consult your tax professional to address your specific taxation requirements. goPeer provides investors with a T5 Form.

Managing risk

goPeer closely monitors external macroeconomic conditions in addition to the performance of loans. Where signs indicate worsening conditions, we will make credit strategy changes to favor investor yield for new loans.

In addition, we regularly perform stress tests to simulate what could happen to investor returns during difficult periods, for example during an economic downturn. This is just one of many steps we’ve taken as part of a comprehensive, data-driven approach to risk management at goPeer.

We take the privacy and information security of our investors, borrowers and partners incredibly seriously, and are committed to providing the best level of protection for our customers and their data.

Read our privacy policy for more information about how we collect, store and use data.

We believe that full and strict adherence to regulations is essential to protect both our investors and borrowers, and to build a sustainable business.

Peer Securities Corporation, a wholly-owned subsidiary of goPeer, is registered as an exempt market dealer in Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, Saskatchewan and Québec. You can verify Peer Securities’ registration via the Canadian Securities Administrators “Are they registered?” tool.

goPeer’s securities operations are regulated by each jurisdiction in which it offers securities.

Additionally, goPeer is subject to the provincial laws of each jurisdiction in which it offers and funds loans. On a federal level, goPeer’s lending operations are subject to specific statutes enforced by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), as well as other federal agencies.