Canada's leading private credit marketplace.

Get a low-interest loan funded by your Canadian peers, or become an investor and earn high-yield passive income.

FEATURED ON

OUR SOLUTIONS

Leveraging Peer-to-Peer for Social Good.

Your Financial Freedom Pathway: Debt Reduction to Investment Growth

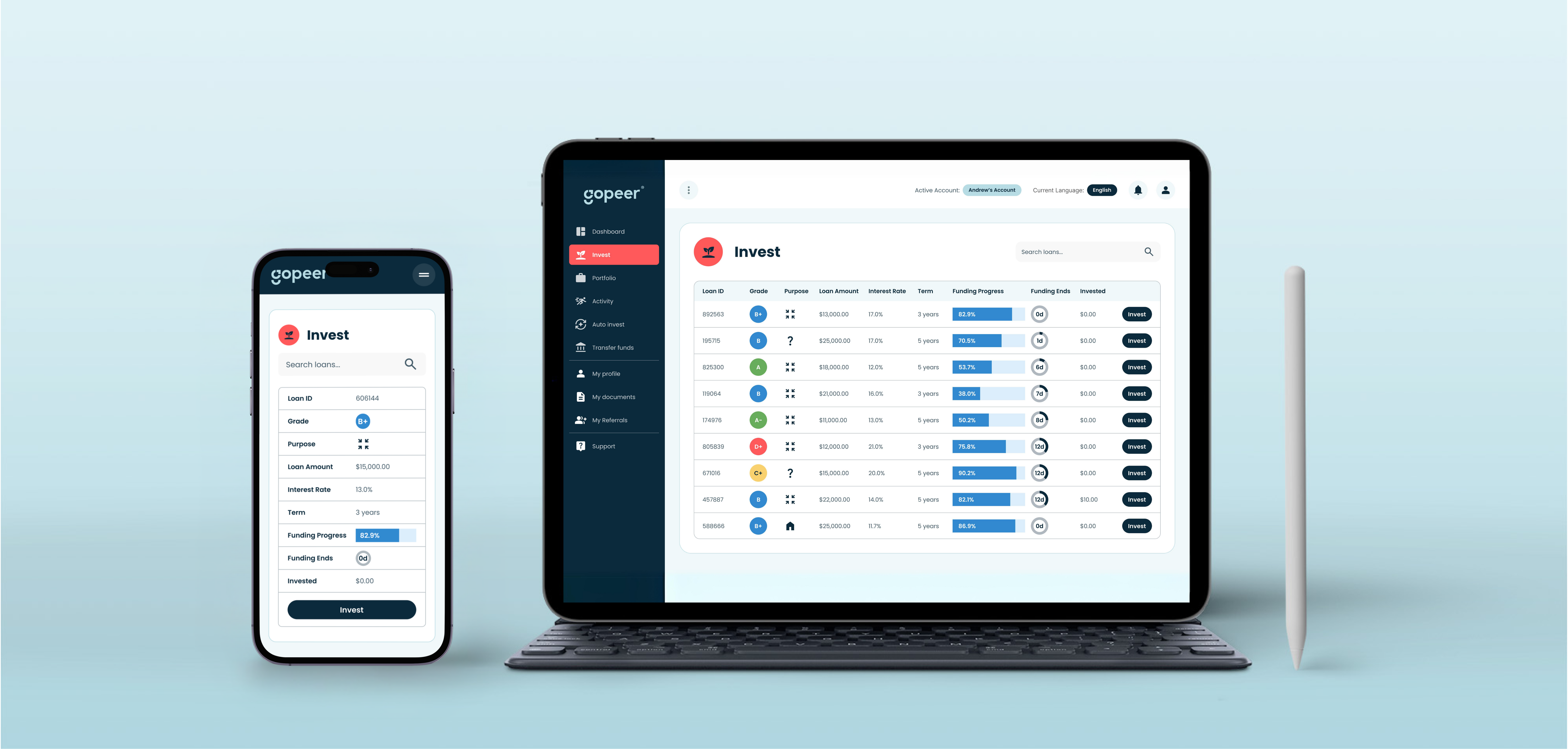

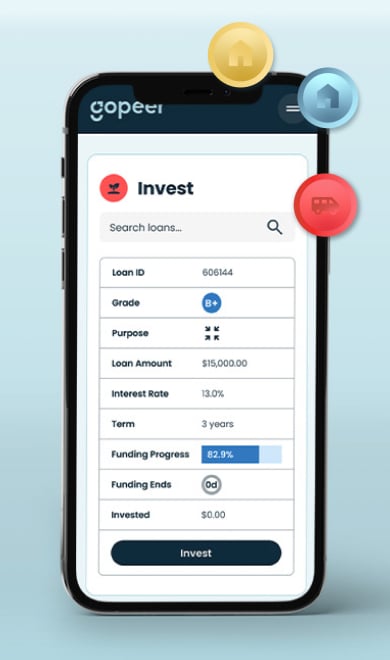

Our platform connects investors directly with borrowers, cutting out the middleman and providing fair access to high-yield investments and capital.

Whether you’re looking to borrow money for a personal loan or invest in private credit, goPeer is the platform you can trust.

goPeer is Canada’s premier private credit platform, connecting investors seeking fixed income opportunities with borrowers needing access to capital.

Our advanced technology ensures a seamless experience for both investors and borrowers.

Join us today and transform the private credit landscape.

For investors

Diversify Portfolio

Enjoy returns with low correlation to stocks and bonds, reducing volatility in your portfolio performance.

Earn Passive Income

Earn passive income daily from interest and principal repayments.

Unique Opportunity

Invest in unsecured personal loans and try something new with Canada's leading private credit platform.

For Borrowers

Fair Repayment Terms

Instead of borrowing from big corporations, we let you borrow directly from everyday Canadians with fair interest rates and repayment terms.

Quick Application Process

Our advanced platform is designed for quick pre-qualification, allowing you to submit an application and receive a response within 24-48 hours!

Easy to Use

Our platform is simple for anyone and everyone to use. Borrow money safely and easily with goPeer.

WHAT PEOPLE ARE SAYING ABOUT goPeer

Reviews From goPeer Users.

goPeer may solicit its clients to leave public reviews. The testimonials presented may not be representative of the views of all investors or borrowers, and your own experience may differ.

Discover a Brighter Financial Future.

Join goPeer Today!

Subscribe to our Newsletter

Subscribe to our newsletter for the latest news and product updates straight to your inbox.

Calgary (Head Office)

500 4th Ave SW, Suite 2500

Calgary, Alberta T2P 2V6

Toronto

111 Peter Street, Suite 700

Toronto, ON

M5V 2H1

Montreal

2001 boul. Robert-Bourassa, Suite 1700, Montréal, QC H3A 2A6

© 2024, goPeer®. All Rights Reserved.

Peer Securities is a member of the Ombudsman for Banking Services and Investments,

and a registered exempt market dealer in all Canadian provinces. NRD #65410

Disclaimer: goPeer offers unsecured personal amortizing loans throughout Canada in amounts from $1,000 to $35,000 with terms of 3 or 5 years and annual percentage rates (“APR”) between 8.99% and 34.99%, depending on an assessment of the borrower’s credit profile, financial position, and ability to service the loan. If a payment is unsuccessful, goPeer may charge an unsuccessful payment fee of $50. If a payment is late 30 or more days, goPeer may charge a late payment fee of $25 or 5% of the payment due, which ever is greater. goPeer charges an origination fee included in the advertised APR. There are no other fees on loans. Loans are subject to credit and underwriting approval and lending rules may vary by province. For example, the average borrowing cost paid on a $10,000 unsecured personal loan at an APR of 19.99%, with a 3-year term and weekly payments of $85.36 is $3,301.20.