Spring often comes with the feeling of wanting to start anew, that’s why the term ‘spring cleaning’ is so popular, people want a fresh start and get rid of the things they consider clutter. But your house isn’t the only thing that you can spring clean, you can also achieve that fresh, renewed energy with your finances.

Not only is it spring, but April is also Financial Literacy Month. It’s the perfect time to educate yourself on how you can declutter your finances and refresh your money habits. That’s why we’re sharing 6 simple ways you can do just that:

1. Review and cancel unused subscriptions

Now I know all of us have experienced that text or email saying we’ve just been charged a random amount from a subscription you don’t even remember. In fact, a 2022 study by brand insights agency C+R research found 42% of consumers have forgotten they were still paying for a service they no longer use [1]. The subscription model has been so popular, especially with recent years seeing the rise of hundreds of streaming services. Companies have made it so easy to subscribe and made it easy for you to forget about resulting in monthly charges for services you no longer use.

The good news? Tidying up your subscriptions is a quick and easy way to cut unnecessary spending and could save you hundreds over the course of a year. Go through you bank statement and look for these recurring monthly charges and figure out what they’re for. List them down and evaluate if this subscription is something that you’re still using. If not, cancel it on the spot and cross it from your list. Regularly reviewing and managing these subscriptions can help in identifying and eliminating unnecessary expenses. Small cuts like these can save you big over time.

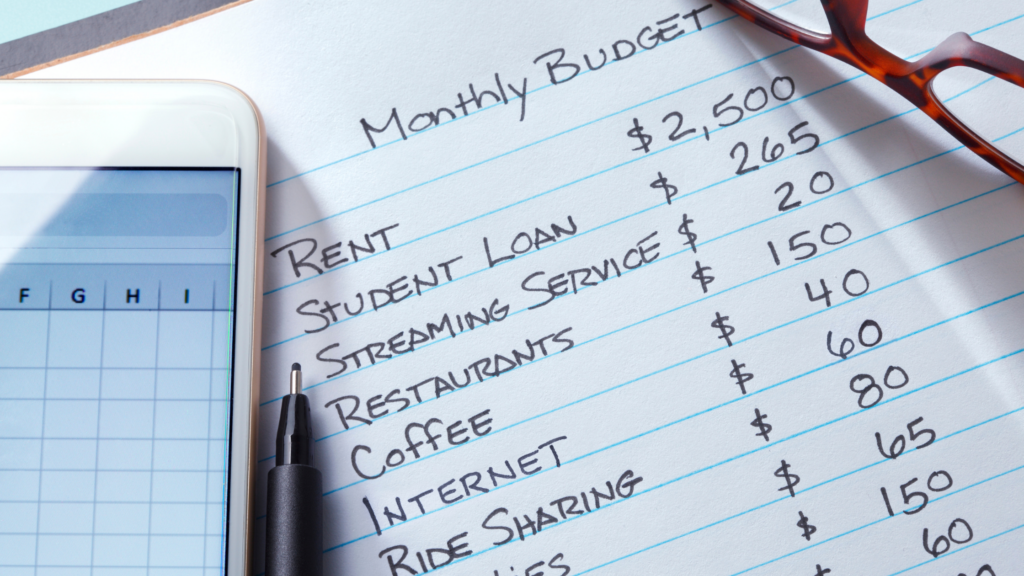

2. Reevaluate your budget and spending habits

Especially in today’s economic landscape, reevaluating your spending habits is more important than ever. Now’s the time to check if your current budget still fits what your goals are and how your lifestyle fits financially. Take a look at your recent expenses and figure out where you’re overspending. You may not even realize it!

For example, your goal is to focus on paying off your debt and building an emergency fund, you might have to cut back on unnecessary expenses for a while. It’s also a good time to consider tracking your spending. Always remember that budgeting is not about restriction but about alignment.

3. Set or revisit your financial goals

Now’s also a good time to think about your financial goals. Your short, mid, and long-term plans that you want to start working on. Maybe even revisit some of the New Year’s resolutions that you’ve abandoned. It’s also worth it to ask yourself if your priorities have changes. Life moves fast and what felt important to you back in January, might not be on top of mind now. That’s completely fine, that’s why it’s important to have your habits evolve with you.

Are you saving up for something specific? Your retirement? An upcoming trip? Make up a plan to start or get back on track towards these goals. You can break down these goals into clear and actionable steps. For example, you’re saving up for a trip, figure out how much you need, do some research on prices of your planned destination then set a realistic monthly savings target. Don’t forget to track your progress whether it’s on a physical notebook, app, or spreadsheet. Seeing what you’ve achieved so far will keep you motivated and help you stay on track.

4. Check your credit report

Maybe you haven’t checked on what’s on your credit report in a while, you’re not alone. But taking a regular look at your report is one of the easiest and most important steps you can take to make sure your finances are in order. According to an FTC study, one in four consumers identified errors on their credit reports that might affect their credit scores [2].

Check for errors and suspicious activities on your credit report and report any that you see.

How often should you check?

Well, ideally you should do it at least once a year. Think of it as a financial wellness check-up just to make sure everything’s in order.

You can request a free copy of your credit report from either of Canada’s two main credit bureaus:

- Equifax – equifax.ca

- TransUnion – transunion.ca

Both of them offer access by mail or online.

What do you look for?

- Incorrect personal information (name, address, etc.)

- Accounts you don’t recognize (could be fraud)

- Late payments or collections that don’t belong to you

This is a small step but can have a huge impact. Especially if you’re planning on applying for a loan, mortgage, or a new credit card down the line.

5. Rebalance your investments

Similar to tuning up your car, your investments need a check-in too. Rebalancing your investments just means reviewing where your money is invested then figuring out if it still aligns with your goals and risk tolerance.

It’s okay if your focus has shifted, maybe you’re now thinking more about retirement that when you first started investing. Or maybe you realized that you’re more conservative (or more aggressive) initially. It’s totally normal for your goals and comfort levels to change over time.

6. Get organized

Finally, let’s declutter. Instead of letting all your receipts, statements, and invoices pile up in a folder or a drawer somewhere, try creating a way to make everything easy to track and find.

You can start by digitizing important documents and storing them securely either on a secure drive or a could-based tool. Label them by year, type, and whatever category makes it easy for you to keep track of everything and maintain access to them without digging through piles and piles of paper. The more organized your finances are, the more confident and in control you’ll feel throughout the year.

Final Thoughts

Spring is all about blooming and fresh starts and your finances definitely deserve one. Whether it’s cutting out unnecessary subscriptions, or revising your goals, taking small steps can lead to big improvements.

You don’t have to do everything at once, you can just focus on one at a time. You got this!