Since over a decade, interest rates have been at historically low levels — the Bank of Canada’s target rate is currently at 1.75% — and not looking likely to increase any time soon. Savers across the country are looking for new ways to make their money work, and peer-to-peer lending represents a great opportunity. This type of investment comes with different risks than with those you’ll find in traditional investments, but there’s potential for greater earnings as well.

Consumer Credit is the Cash Cow of Most Banks

Investing through goPeer means you gain exposure to consumer credit, which is the debt of another person, a borrower. Organizations that provide the opportunity to gain investment exposure to consumer credit, such as goPeer, are called peer-to-peer lending platforms.

While you’re likely familiar with consumer credit as a borrower through using credit cards or taking out loans, you may not be familiar with it as an investment option as it’s only recently been made available to individual investors. In fact, Canadian banks and large financial institutions have kept a tight grip on the lending business.

Earn Solid Returns

As of this writing, the current average rates on traditional fixed income investments remain low:

- Government of Canada Bonds (5 year): 1.13%

- GICs (3 to 5 years): 1.50% to 2.50%

- Canadian corporate bonds index: 2.54%

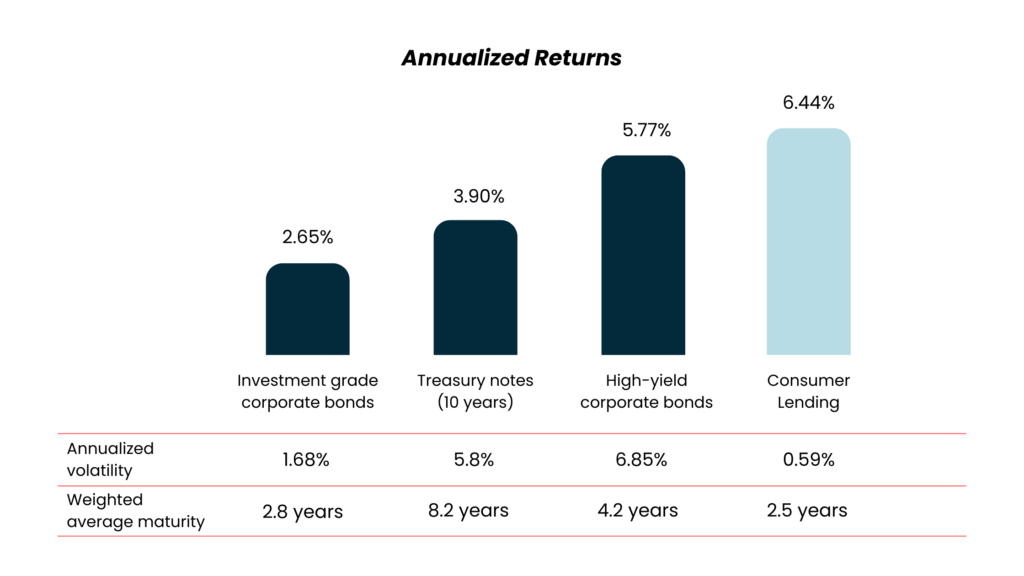

Peer-to-peer lending offers the opportunity to earn more attractive returns on your investment. According to PwC, alternative lending has produced solid returns at a fraction of the volatility of other asset classes and at a shorter weighted average maturity, as shown below.

Peer-to-peer lending offers a particular type of credit risk premium not available with traditional assets. It gives access to consumer credit at a single loan level, with no leverage, tranching or other funky derivative structure, enabling investors to access credit risk premium in its simplest form – which has traditionally been the banks’ cash cow. In addition, investors are compensated for holding their notes until maturity in the form of an illiquidity return premium.

P2P Lending Diversifies Your Investment Portfolio

Portfolio diversification is the practice of spreading your investments across different uncorrelated assets so that you limit your exposure to any one specific event. This practice is designed to mitigate the risk of your portfolio over time. To obtain real benefits from diversification, investment portfolios must be constructed with assets that are minimally correlated to each other.

Historically, consumer credit has added persistent portfolio diversification irrespective of the assets it’s compared with. Institutional investors have realized the true diversifying value of alternative lending, and this has prompted them to allocate a growing share of their investment portfolios to this asset class.

How does P2P Lending Compare to Other Investments?

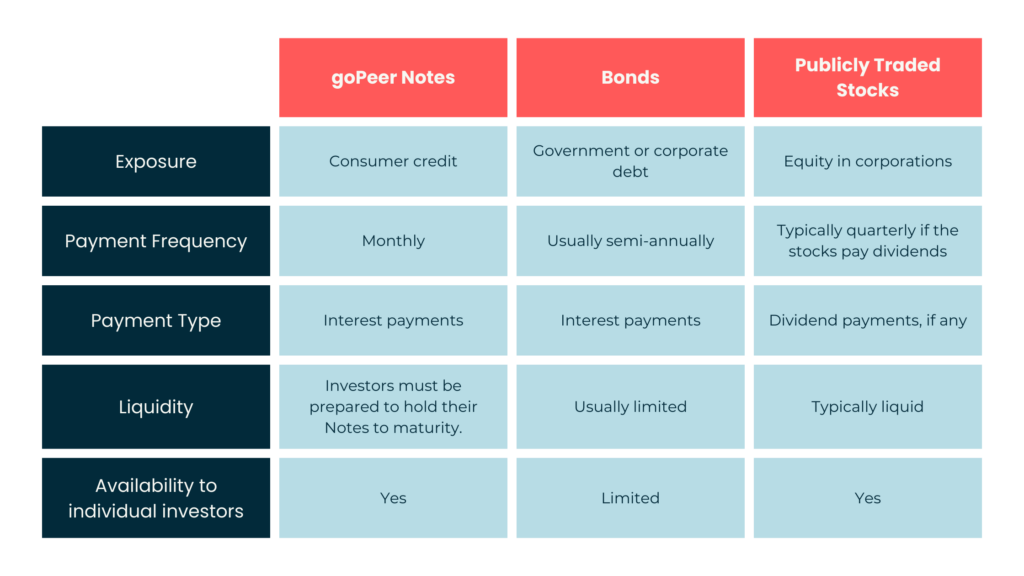

Diligent investors should understand the key features of consumer credit as an investment vehicle, and how it compares to traditional asset classes like stocks and bonds. The table below offers a high-level comparison of the different asset classes.

Bottom Line

In short, investing in consumer credit has historically been only available to banks and large financial institutions. We’re proud to make this asset class available to individual Canadian investors and offer them an additional tool to diversify their portfolio.

Peer-to-peer lending provides solid returns with short weighted average maturity and predictable cash flows. Furthermore, as an asset class, consumer credit adds true diversification to investment portfolios. Replacing a small portion of the fixed-income allocation in an investment portfolio with peer-to-peer loans may significantly improve your risk-adjusted return.

If you’re unsure whether lending is right for you, you should seek independent financial advice before you start. Remember by lending your capital is at risk, while tax rules and relief can change depending on your personal circumstances.