Canadians have lost $638 million to fraud in 2024 according to the Canadian Anti-Fraud Centre (CAFC) [1]. Scams are getting more and more creative and the use of AI has made it easier for fraudsters to trick people. In this post, we’ll break down the most common financial scams that Canadians are falling for and how to avoid them.

1. Government Impersonation Scams

How it works: One day, you’re sitting at home, minding your business then you get a random phone call and the caller ID says it’s from the CRA. You answer it and the voice on the other line says that there’s a case against you being filed by the CRA and unless you settle the fines you owe right away, you will face legal consequences.

Scammers will call, text, or email you claiming that you have some sort of violation and would need to pay a fine immediately, preying on your fear and creating a false sense of urgency. They claim to be from a government branch including the CRA, police, or immigration services and often use spoofed caller ID to look more official.

Red flags to watch out for:

- Threats of immediate arrest and use of threatening language;

- Request for prompt payment over the phone, via gift cards, or wire transfer;

- Pressuring you to act immediately.

How to protect yourself:

- Government agencies will not pressure you to make payments over the phone;

- If you’re suspicious of a call or message you receive, hang up the phone and call the concerning agency using their official contact details;

- Always report suspicious calls and block the numbers.

Here’s an example of a CRA phone scam, take a listen:

2. Banking and Phishing Scams

How it works: You receive an email or text claiming to be from your bank and asking you to confirm your details. These messages claim that your account is being suspended or deactivated unless you login immediately using the link they provided. Sometimes, they will even claim that you’ve received a fund transfer to your account and that they need you to confirm your details so you can get the money.

These messages will often include links to fraudulent websites that steal your login information once you enter them.

Red flags to watch out for:

- Urgent messages asking you to click a link or confirm your information;

- Spelling mistakes or strange-looking sender email addresses;

- Requesting sensitive information like your account numbers or passwords.

How to protect yourself:

- Banks will never ask for your login details, let alone over email or text.

- Typing your bank’s website manually instead of clicking any links sent in an email or text.

- Use two-factor authentication to protect your accounts from unwanted logins.

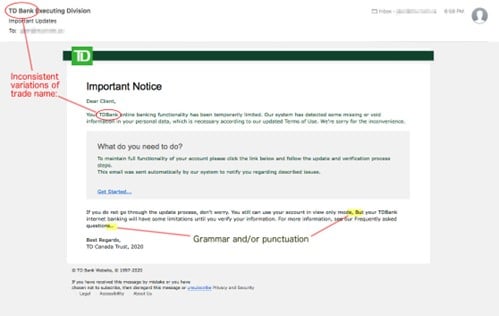

Here’s an example of a phishing email and what you should watch out for [2]:

They will also often have an unrelated email address like so:

And links that are suspicious and unrelated:

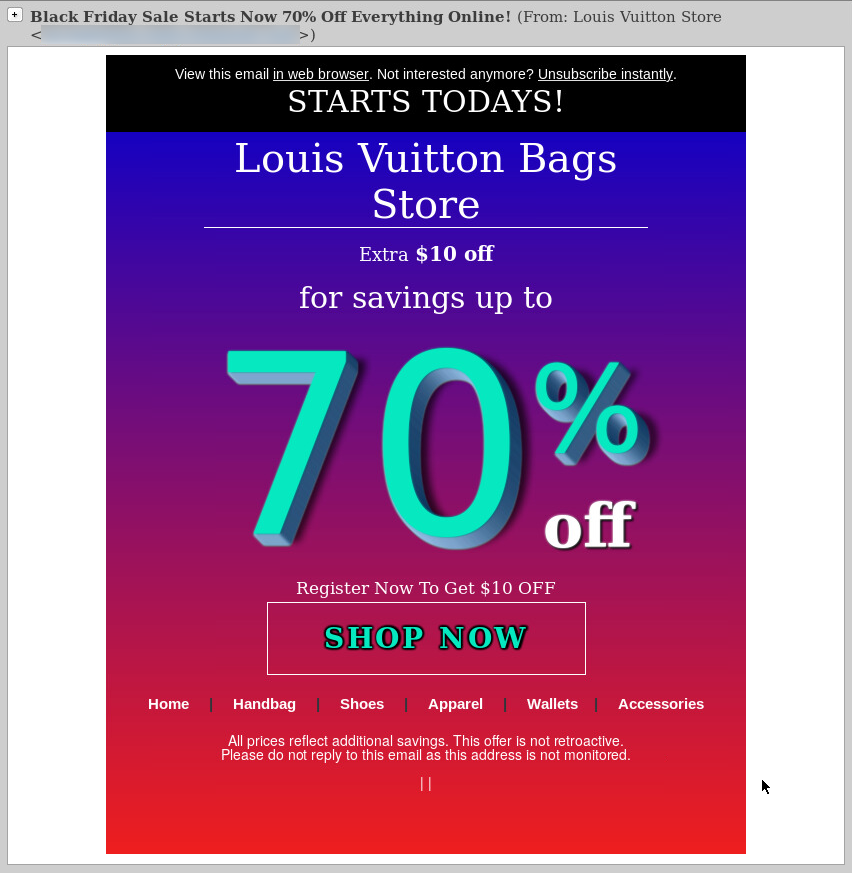

3. Online Shopping and Fake Retailer Scams

How it works: You find a great deal online from a social media ad or on a website you were browsing. You decide not to let this “once-in-a-lifetime” discount pass and make the purchase, after all, it wasn’t a huge amount of money compared to the potential return. But, after paying the product never arrives, or you were informed that it was shipped and on the way to you but after weeks of waiting, what you get is cheap, fake, or completely different from what you actually ordered.

The reason why it can take weeks for your “order” to be shipped is for the scammers to be able to have their websites up as long as possible without getting flagged. They prey on people’s “FOMO” and use scarcity marketing in order to drive demand and create a sense of urgency.

Red flags to watch out for:

- Deals that are too good to be true;

- A recently created website or customer reviews that seem fake or keep repeating the same sentiments about the product;

- Sites that only accept certain payment methods like crypto, wire transfer, etc.

How to protect yourself:

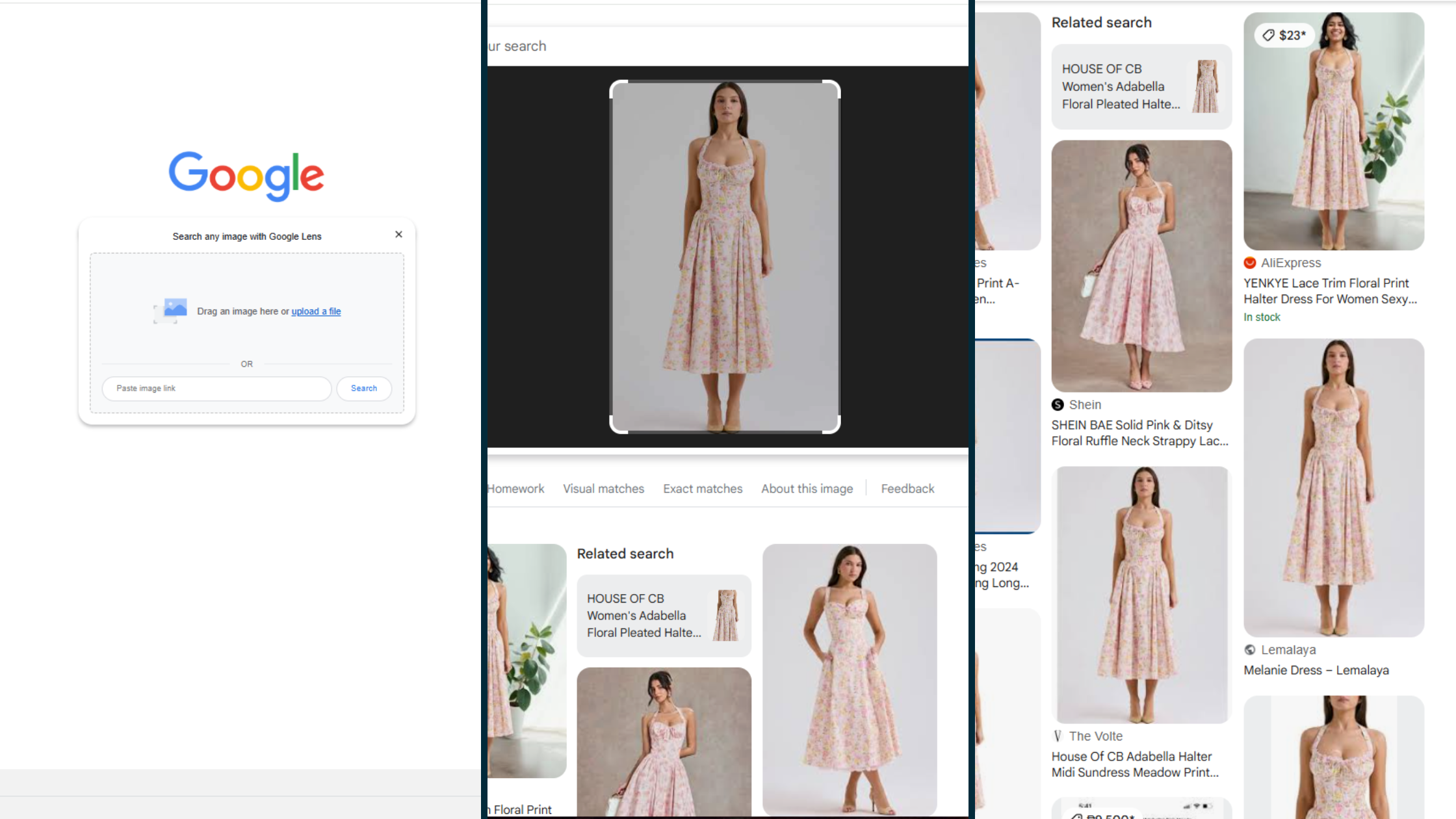

- Research the brand and seller and check reviews from different platforms;

- Avoid shopping on unfamiliar websites;

- You can use a reverse image search tool to see if their product listings were lifted from a different brand.

*Reverse image search of a dress from being copied and used on different websites.

4. Fake Investment and Crypto Scams

How it works: Scammers will promise you huge returns with no risk through fake investment platforms or insider crypto opportunities. They usually utilize online forums and social media to lure their victims into phony investments.

There are numerous types of these scams, including:

- Crypto Ponzi schemes: Like a typical Ponzi scheme, once you invest, that money will be paid to early investors instead of earning real returns.

- Pump-and-dump: Fraudsters artificially boost the price of a small, unknown stock or crypto coin through misleading hype, then sell off their shares at a profit, leaving investors with worthless assets.

- Fake Trading Platforms: You deposit money into a website that looks like a real trading platform, and you may even see fake profits. But when you try to withdraw, your money is gone.

Red flags to watch out for:

- Guaranteed high returns with no risk;

- Pressure to act fast and invest immediately;

- No clear information on the company or crypto. Legitimate investment firms are registered and regulated. Check out how goPeer is regulated.

How to protect yourself:

- Always do your research before investing into anything;

- Never invest under fear of missing out or letting your emotions drive you;

- Use reputable investment platforms.

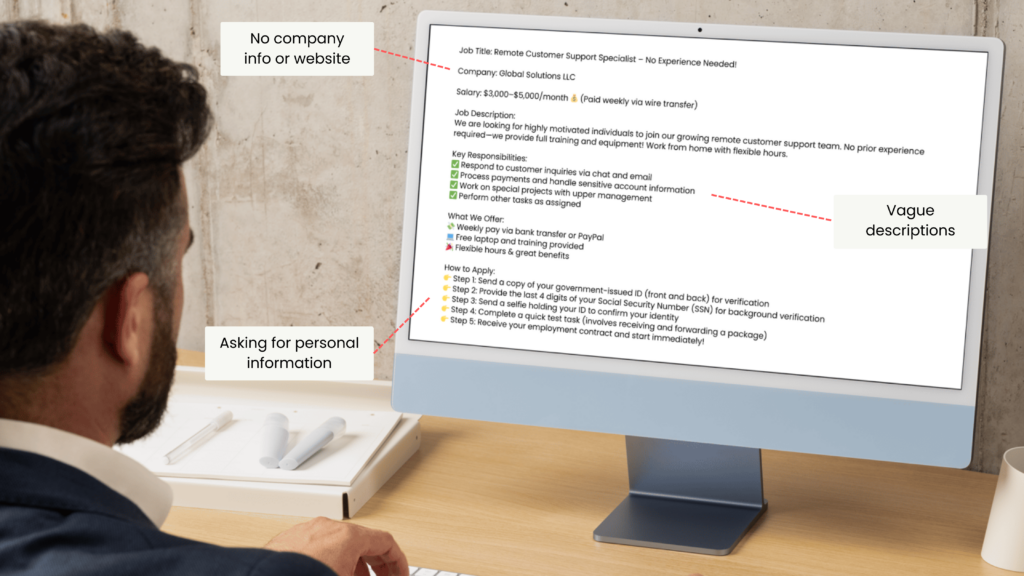

5. Fake Jobs Listings

How it works: Scammers will post fake job listings, often using legitimate online job search sites or contact people directly with the promise of an easy work with flexible hours and high salary. Once they get into contact with these employees, the “employers” would ask them to pay for training, uniforms, supplies, etc. before starting the job.

Other times, what happens is these scammers would get the prospective employees to commit fraud on their behalf by cashing counterfeit cheques. They would come up with a convincing story about why they need the cheque to be cashed by the employee and have them send the funds back.

Red flags to watch out for:

- Jobs that require you to pay something upfront;

- Employers that ask you to cash cheques or transfer money on their behalf;

- Employers that only communicate via messaging apps.

How to protect yourself:

- Research companies online, either through LinkedIn or other official job sites;

- Don’t send your personal information before you verify that the company is legitimate;

- If a job sounds too easy and too good to be true for the pay, it’s probably a scam.

Final Thoughts

With continuous advancements in technology, AI, and social engineering, some people will always find a way to use these to take advantage of other people. They’re constantly evolving their tactics and tricks to deceive people. But the good news is, you can outsmart them by staying informed and skeptical. Trust your instincts if it tells you that something feels off.

A Few Key Takeaways to Protect Yourself:

- Verify and take time to check the facts.

- Don’t let fear of missing out guide your decision making. Scammers will rely on urgency and pressure you to act fast.

- Never share personal information unless you’re 100% sure you’re dealing with a legitimate entity.

- If it’s too good to be true, it certainly is.

- Use strong passwords and two-factor authentication on your accounts.

- Report scams. If you suspect something to be fraudulent, you can report it to the Canadian Anti-Fraud Centre.

The more people know about these scams, the harder it becomes for fraudsters to succeed. Awareness is the best defense.

Source:

[1] https://www.canada.ca/en/competition-bureau/news/2025/02/fraud-prevention-month-to-focus-on-impersonation-fraud-one-of-the-fastest-growing-forms-of-fraud.html

[2] https://scotialogic.com/spot-phishing-emails-like-a-boss/

[3] https://www.welivesecurity.com/2019/11/28/5-scams-watch-out-shopping-season/