Invest in Consumer Loans,

Earn Passive Income

Trusted by over 100,000 Canadians

Earn Passive Income with goPeer

goPeer enables Canadians to invest in community-driven loans, offering diversified opportunities beyond traditional markets.

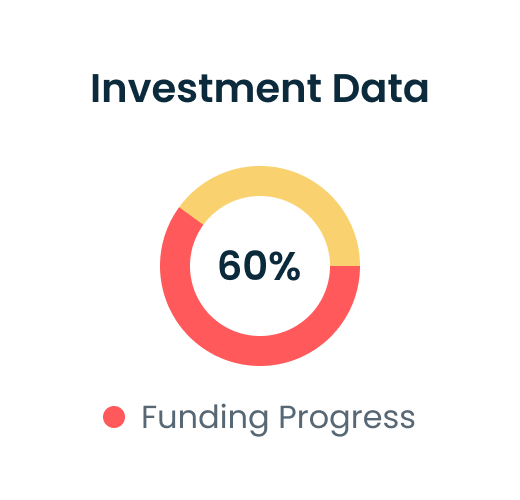

Diversify Portfolio

Enjoy returns with low correlation to stocks and bonds, reducing volatility in your portfolio performance.

Earn Passive Income

Earn passive income daily from interest and principal repayments.

Unique Opportunity

Invest in unsecured personal loans and try something new with Canada's leading private credit platform.

Data as at March 31, 2025, updated quarterly.

EMPOWERING CANADIANS TO INVEST BEYOND TRADITIONAL MARKETS

A Smarter Way to Invest.

At goPeer, we open doors to private consumer credit by connecting Canadians to community-driven consumer loans. This high-yield opportunity empowers investors to diversify their portfolios while supporting fellow Canadians.

With competitive interest rates, our alternative investment options offer potential for stable returns while helping Canadians achieve their financial goals.

The goPeer Platform

Explore the marketplace

Browse through the platform and select the loans that match your investment objectives.

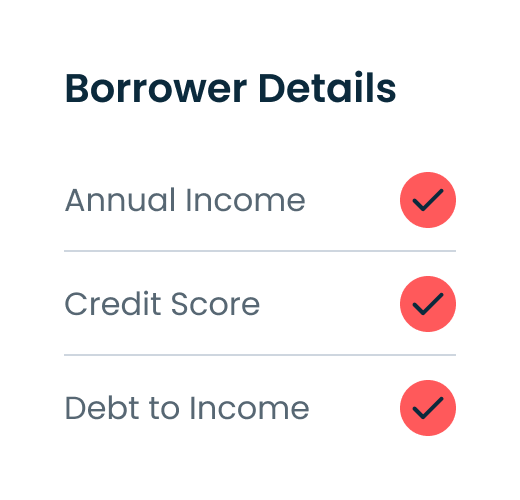

Perform due diligence

Each investment note provides borrower details such as their annual income, credit score range, debt-to-income ratio, and more.

Portfolio & Activity Tracking

Gain in-depth insights of your investments made through goPeer. Export and analyze your portfolio data as you wish.

Investing on Auto-Pilot

With Auto Invest , goPeer can do the heavy lifting for you. Auto Invest actively looks for investment notes based on your preferred risk grades and uses a portion of your available funds to automatically invest into them.

Sit back, relax and earn

passive income.

No initial investment required to discover your alternative investment journey.

FEATURED ON

*Disclaimer

This material contains certain tables and other statistical analyses that have been prepared by goPeer. Actual figures may differ. Numerous assumptions have been used in preparing this statistical information, which may or may not be reflected in the material. The statistical information should not be construed as legal, tax, investment, financial, or accounting advice. The Information is provided as of the dates shown and is subject to updating and revision, and may change materially without notice. Subject to applicable regulations, no person is under any obligation to update or revise the information. The information may contain various forward-looking statements, which are statements that are not historical facts and that reflect goPeer’s beliefs and expectations with respect to future events and financial and operational performance. These forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other factors, which may be beyond the control of goPeer and which may cause actual results or performance to differ materially from those expressed or implied from such forward-looking statements. Nothing contained within the information is or should be relied upon as a warranty, promise, or representation, express or implied, as to the future performance of any loans. Any historical information contained in this statistical information is not indicative of future performance.

Please note:

Past performance is not a guide to future returns, and your capital is at risk when investing through goPeer. As you are investing to your own individual portfolio of loans, your actual return and the actual bad debt you experience may be higher or lower than projected net returns. Please reach out to a Dealing Representative registered with Peer Securities Corporation (operating as goPeer) if you have any questions.

Calgary (Head Office)

500 4th Ave SW, Suite 2500

Calgary, Alberta T2P 2V6

Toronto

111 Peter Street, Suite 700

Toronto, ON

M5V 2H1

© 2024, goPeer®. All Rights Reserved.

Peer Securities is a member of the Ombudsman for Banking Services and Investments,

and a registered exempt market dealer in all Canadian provinces. NRD #65410