One of the biggest milestones in your life is being able to study and graduate as this marks the beginning of a whole new chapter in your life. However, transitioning from your life as a student to a working professional can also be daunting. The good news? This is the perfect time to lay the groundwork for building long-term wealth.

You don’t need a huge salary to get started, just a little consistency and building smart habits early on will set you up for financial independence down the line.

Lesson 1: Start Early (even if it’s small)

The single biggest advantage you have as a recent grad? Time.

Time is a the most important non-renewable resource in the universe and you’ve been blessed with a lot of it. Compounding interest is your best friend. Starting early, even with small amounts can lead to greater returns down the line than if you started late with more money.

Let’s break it down:

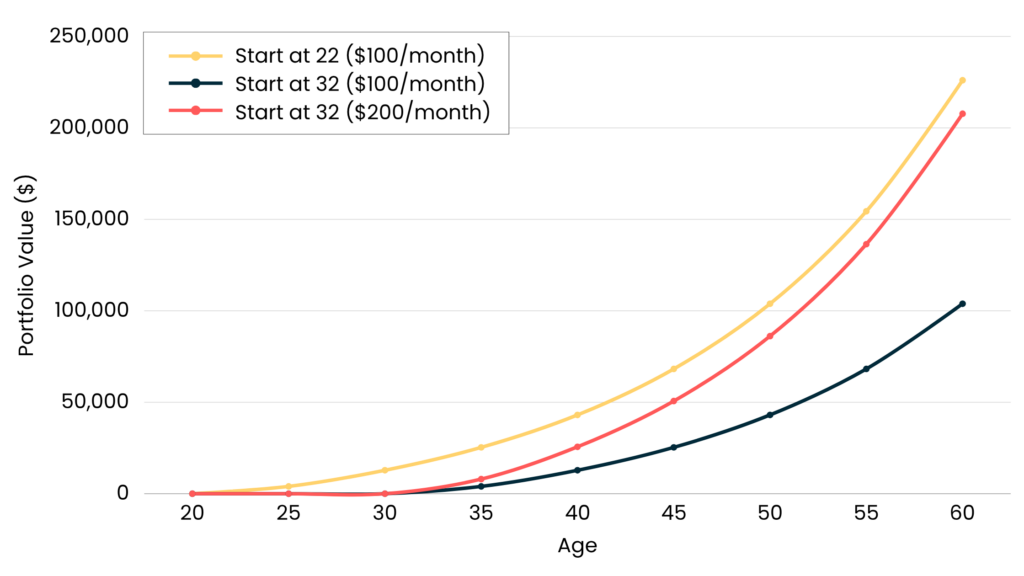

- Start at age 22, invest $100/month → $226,050 by age 62

- Start at age 32, invest $100/month → $103,869 by age 62

- Start at age 32, invest $200/month → $207,738 by age 62

Even doubling your monthly investment doesn’t beat starting early with a smaller amount. Time beats timing. The earlier you start, the more your money works for you even if you’re investing less.

Lesson 2: Automate Your Contributions

One of the best ways to build wealth over time without overthinking it is to automate your finances. You can set it up so that they’re taken out of your account as soon as you get paid, this way you get to do it without even thinking about it.

You can set up an automatic transfer to:

- A high-interest savings account for your emergency fund

- A TFSA or RRSP

- An investment platform for passive income

This approach is “out of sight, out of mind” and your future self will thank you.

Lesson 3: Diversification Isn’t Just for a Large Portfolio

You don’t need to have a huge capital to start building good investing habits. Even with minimal or small contributions, you can already start getting into the habit of diversifying your investments.

In addition to traditional investments, retail-friendly platforms make it possible to invest in:

- Fractional real estate

- Consumer credit

- Green bonds and other ESG assets

Getting into the habit now protects you against volatility and builds a more resilient portfolio down the line.

Lesson 4: Habits > Timing

Good habits are very easy to build, especially if you start early. You don’t need to be an expert to gain control over your finances. It’s your daily habits that make you, not perfectly timing the market and that makes the biggest difference in the long run.

By setting yourself up now and building smart financial routines early, you can reduce anxiety and lay a solid foundation. Think of it like brushing your teeth, it’s the consistency of your routine that matters and now how fancy your toothbrush is.

Here’s what you should focus on:

- Living within your means: This doesn’t mean cutting out all enjoyment, it just means being intentional with your spending. Your mindset on money shouldn’t be “What can I buy with this?” but rather “How can I make this money work for me?”

- Avoiding any high-interest debt: Debt isn’t always bad but it can quickly snowball and get out of hand, especially credit cards that feel like free money until the bill comes in. Be smart and borrow with a plan to repay and always pay more than the minimum.

- Building credit responsibly: Good credit can open up opportunities to lower interest rates and better financial opportunities in the future.

- Consistency: Stick to your plan, even in downturns. Time in the market beats timing the market.

Final Thoughts: You Don’t Have to Get It Perfect, Just Get It Started

Perfection is the enemy of success. You don’t have to get everything right or know everything there is to know, you just need to take that first step. Whether it’s putting aside $50/month or signing up to your first investment platform, starting early just means you have time on your side and that’s the most powerful financial tool you can ever have.