You may have heard the term Socially Responsible Investing and perhaps you want to find ways to help contribute to society. In this article, we explain what socially responsible investing is, how to access it and what the returns are like.

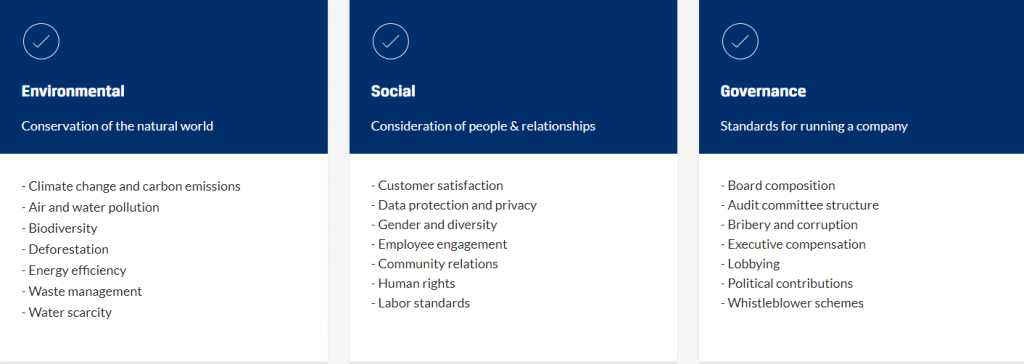

Socially Responsible Investing (SRI) has been around for more than a hundred years. It involves applying social and environmental factors to choose investments. SRI basically means investing money into good things that have a social impact, such as waste management, energy efficiency, data protection, etc, as appose to investing into bad things such as companies that manufacture guns, sell tabaco, related to gambling or harm the environment. Over the years, socially responsible investing has become more standardized and easier to examine, however values may differ from one person to another. Investors can research if a company has certain standards and use a quantified metric called the Environmental, Social & Governance (ESG) score to understand if a company is practicing social responsibility. According to an article by Forbes, ESG investing is estimated at over $20 trillion in assets or around a quarter of all professionally managed assets around the world

ESG Factors include:

How to Access SRI

One of the ways you can be a socially responsible investor is to buy individual stocks that focus on socially responsible values. You can research about the company and understand their practices, or simply check their ESG scores (you can find this metric on Yahoo Finance or similar financial websites) to better understand their efforts in environmental, social, or governance issues. Make sure your values align with the ESG score of the company and you’ll be all set.

You can also explore investing into SRI index funds or ETFs. These funds do all the screenings for you such as avoiding tabaco, guns, animal testing, etc, so that it’s little work on your end. They basically tally up high ESG scoring companies in the financial markets and bundle them into one fund for investment. Some funds focus on particular areas of social causes such as companies that puts more efforts on gender equality, environmental issues, waste management, etc. Keep in mind that even though these funds look for high scoring ESG companies, they may not align with your own values and goals. Investors should carefully read through the fund prospectuses in order to determine the exact criteria being used by fund managers, along with the potential profitability of these investments.

Another great way to have a socially responsible investment strategy is by lending money to regular people through peer to peer lending. This is primarily done through online platforms where investors are connected to borrowers looking for loans. Everyday borrowers can have a better chance at achieving financial freedom by borrowing from fellow peers as opposed to visiting traditional lenders with sometimes enormous fees and hidden costs. On the other side, investors have the chance to help a person in need and invest into them while making attractive returns. Another benefit of peer-to-peer lending is that investment returns are not correlated with the stock markets’ volatility, and thus they are achieving investment diversification. To learn more on peer-to-peer lending, check out our website: gopeer.ca.

How do SRI Returns Compare to Regular Investing?

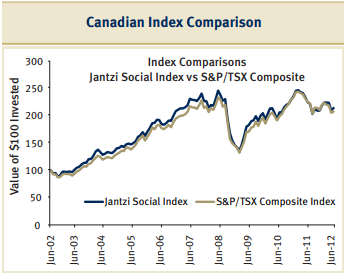

Many wonder whether investing into socially responsible companies will affect their overall investment returns. According to a report by RBC Global Asset Management, historical performance between two SRI indexes (Jantzi Social Index & KDL 400) compared to the Canadian or US Stock Market Index, respectively, show that there is very little difference in terms of gains or losses, in fact, the SRI indexes slightly outperforms both the Canadian and the US markets.

That being said, investing comes down to what matters most to you. Investing into socially good causes may bring you more than just financial returns!