In the world of investing, the concept of asset class diversification is commonly associated with the age-old idiom and analogy of not putting all of your eggs into one basket. The theory can be applied to many areas of life, such as relationships, education, business, finance and of course, investing.

To put this notion into the context of investing, imagine that you own $60,000 of Amazon shares, and that is the extent of your portfolio. It means the stability of your wealth is entirely dependent on the performance of a single asset. The value of Amazon stock is always on the move, as is any financial instrument traded in an open market.

For example, you can expect share prices to fall if Amazon gets hit by an enormous fine, such as the penalty of as much as $37 billion which the European Union is considering charging the company for breaking antitrust practices.

If all your eggs are in one basket, i.e. all your capital is held in Amazon shares, and the price drops, you’ll lose some eggs. Therefore, what informed investors do is diversify their portfolio into numerous asset classes to hedge each of their investments against the potential impact if one of them underperforms.

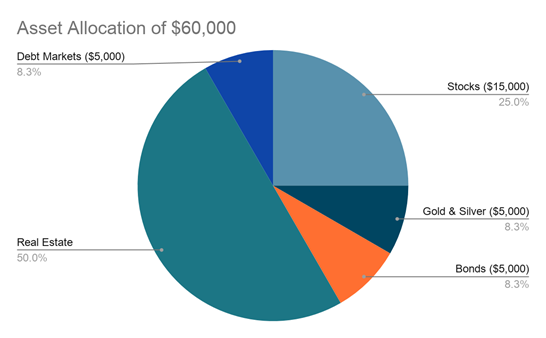

For context, here is an example of a diversified investment portfolio.

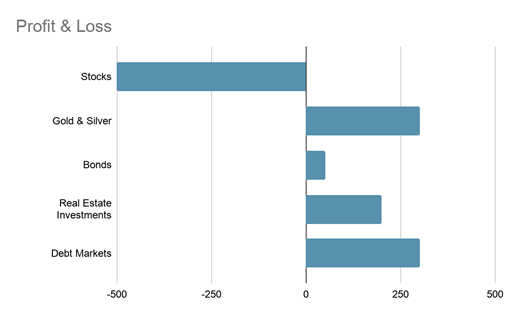

Below is an example of how each of those assets could protect one another should the performance of one of the assets fall. In the diagram, you can see this portfolio is losing $500 from investment in stocks, whereas, in total, the portfolio is at a profit of $350.

In this article, we’ll explain why asset class diversification is so important and how you can begin to apply asset class diversification. But first, we’ll introduce the most common asset classes, their characteristics and correlations and the role each can play in a diversified portfolio.

Equities

Equities, also known as stocks or shares, are familiar to most people with a TV set or internet connection. Almost anyone in Canada can open an investment account with their bank are a broker-dealer to purchase stocks from the NYSE, NASDAQ, TSX, or another market.

The performance of the stock market isn’t merely driven by the success of each company listed on the exchange. Some companies perform and underperform irrespective of their fundamentals. The concept of indices and ETFs, which are basketed products, have caused a strong correlation in the price of all shares listed on a stock exchange. If Amazon underperforms, it can cause investors to withdraw their funds from those baskets and therefore, many other unrelated equities across several industries.

All equities are strongly correlated, and buying shares in companies from different industries will not protect your portfolio from a downturn that affects the entire stock market.

- Equities historically have a positive upside in the long term. Sometimes they pay dividends.

- Equities are volatile and have strong correlation across the market.

Bonds

For decades, even centuries, government-issued bonds have been considered a safe haven asset class. When a government issues a bond, it’s essentially borrowing money from investors and paying it back in the future, with interest.

Bonds deliver reliable yields with close to zero-risk. The average yield rate of a US government bond with a maturity of ten years is 4.4%. Many conservative investment portfolios allocate a large proportion of capital to treasury notes.

However, since the COVID-19 pandemic shook the world, the yield received for investing long term bonds has fallen close to 0.5%. A significant amount of capital being used by conservative investment portfolios has not only become dry powder but has lost its ability to hedge against any losses from more volatile assets, such as equities.

- Bonds are almost zero-risk and guarantee a fixed amount of income.

- Bonds do not currently yield meaningful returns that are helpful in a portfolio

Commodities

Commodities are broadly defined as raw material that is yet to be manufactured into a product which is valuable to consumers. For example, barrels of crude oil that haven’t been refined into gasoline, or cocoa that’s just bagged up waiting to go into a bar of Cadburys or gold bars that will soon become a batch of wedding bands.

In the world of investing, the most popular commodities for the average investor is precious metals, such as gold and silver. Investors will either buy physical bullion, like the world-famous Maple Leaf or as a derivative. Precious metals are renowned for their ability to retain value through recessions and even depressions.

- Precious metals are not correlated with traditional financial markets, such as bonds and equities.

- Physical bouillon costs much more than the spot price, which will be paid when coins or ingots are liquidated.

Debt instruments

Debt can be issued as an instrument and bought by investors in a manner which is very similar to bonds. The primary difference is that private debt instruments are not issued to aid government spending, but rather private citizens.

With the absence of attractive yields from government-issued bonds, investors have been struggling to find fixed-income and low volatility assets to invest their capital or hedge their riskier investments, such as equities. A solution that has piqued the interest of open-minded investors is the emerging opportunity in the peer-to-peer lending space, of which goPeer is at the forefront in Canada.

How to diversify an investment portfolio

Amateur investors believe the sole objective of investing is to make as much money as possible. Experienced investors know the goal of investing is to create and preserve wealth. To give a fundamental idea of how to diversify an investment portfolio, you would allocate a part of your portfolio to different asset classes. Even though stocks could theoretically yield the most, it’s not a guarantee they will. Therefore, strategic investors distribute their capital across various asset classes to allow each investment to shield one another from downside.