Discover how goPeer’s circular credit model has helped Canadian investors earn over $8 million in interest. Learn how circular credit models work and why it may be a smart alternative investment to add to your portfolio.

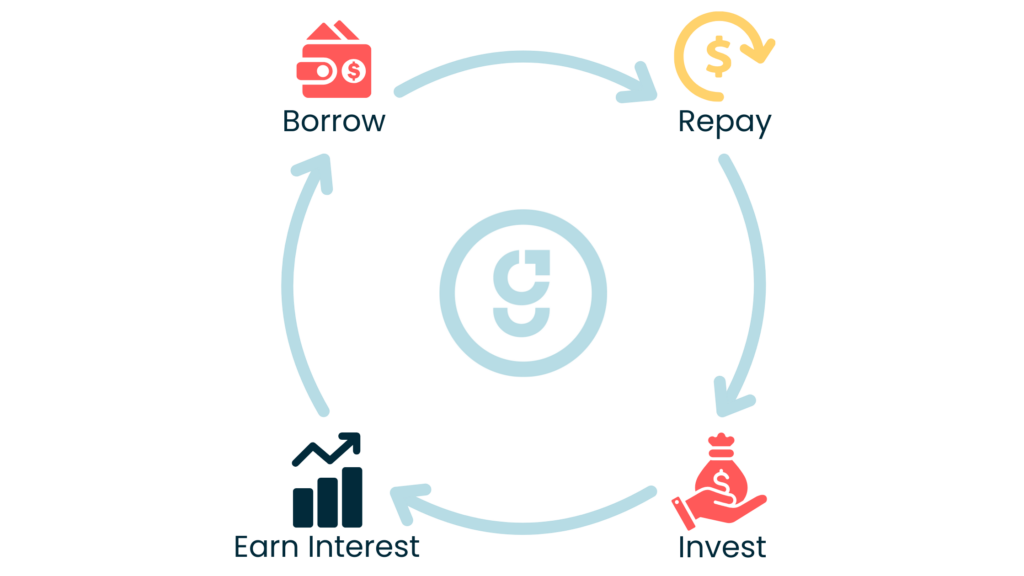

What Is a Circular Credit Model?

goPeer connects borrowers to individual investors who are interested in investing in consumer debt as an alternative asset class. goPeer allows investors and borrowers to bypass traditional banks and lend directly to and from each other. Here’s how it works:

Borrow: Everyday Canadians apply for personal loans, usually to consolidate debt, cover medical bills, or manage expenses. goPeer evaluates credit profiles and assigns interest rates accordingly.

Repay: Borrowers repay their loans through fixed payments that include both the principal and interest.

Invest: Those repayments can be reinvested into new loans, compounding returns and contributing to the cycle all over again.

Earn: Investors earn interest on their capital and help out their fellow Canadians in the process! goPeer’s auto-invest feature also allows investors to automatically reinvest all or a portion of their earnings into new loans, creating a great passive income stream that our investors love.

This creates a circular ecosystem where capital stays within the community and isn’t extracted by large financial institutions.

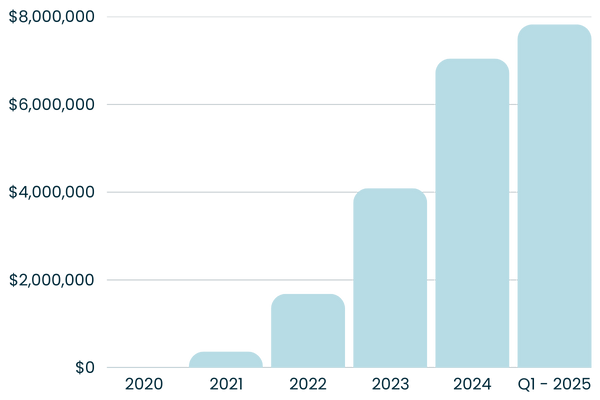

The Result So Far

Since its launch in 2020, goPeer has built a thriving peer-to-peer lending ecosystem. More than 15,400 Canadians have joined the platform as investors, collectively earning over $8 million in interest (and counting!) while funding more than $50 million in personal loans. With a historical annualized net return of approximately 9%, goPeer offers a compelling alternative to traditional fixed-income products, empowering investors to generate passive income while supporting a more inclusive, community-based credit system.

What's Next

goPeer offers Canadians a unique way to invest in their peers and earn consistent, passive income with social impact. Whether you’re looking for diversification, higher yields, or an investment aligned with your values—goPeer is worth a look.

Start investing today or explore detailed loan performance insights at www.gopeer.ca/statistics.

*Disclaimer:

This material contains certain tables and other statistical analyses that have been prepared by goPeer. Actual figures may differ. Numerous assumptions have been used in preparing this statistical information, which may or may not be reflected in the material. The statistical information should not be construed as legal, tax, investment, financial, or accounting advice. The Information is provided as of the dates shown and is subject to updating and revision, and may change materially without notice. Subject to applicable regulations, no person is under any obligation to update or revise the information. The information may contain various forward-looking statements, which are statements that are not historical facts and that reflect goPeer’s beliefs and expectations with respect to future events and financial and operational performance. These forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other factors, which may be beyond the control of goPeer and which may cause actual results or performance to differ materially from those expressed or implied from such forward-looking statements. Nothing contained within the information is or should be relied upon as a warranty, promise, or representation, express or implied, as to the future performance of any loans. Any historical information contained in this statistical information is not indicative of future performance.